- Home

- Newsletter

- Member Update Emails

- Member Update April 9, 2021

Member Update April 9, 2021

Share Paragon's new side-by-side property comparison feature with clients and learn about other system improvements from this week

Paragon was updated on April 7 with new features and enhancements to help you work more efficiently. Here’s a rundown of the new features and enhancements you’ll see the next time you log in to Paragon:

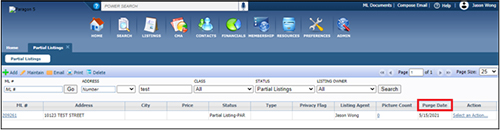

Purge date column added to partial listings table

To help you track when your partial listings will disappear, there’s a new column in the listings table called Purge Date. It calculates and displays the date the system will purge your partial listings so you’ll know how much time you have left to finish and submit them.

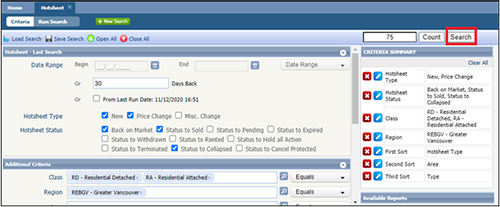

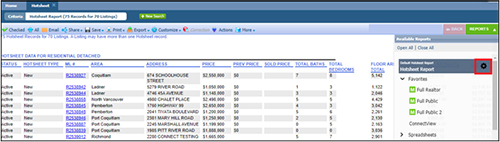

New drop-down menu for your Hotsheet and Tour/Open House reports preferences

You can now specify your default results for Hotsheets and Tour/Open House reports (of which there are many) from the new reports drop-down menu on the right side of the page. Click 'Search'.

Then, click the cog icon to select your report preferences. Once you’ve selected your preferred reports, refresh the page to see them!

Previously, you could only change these preferences from the Preferences Wizard.

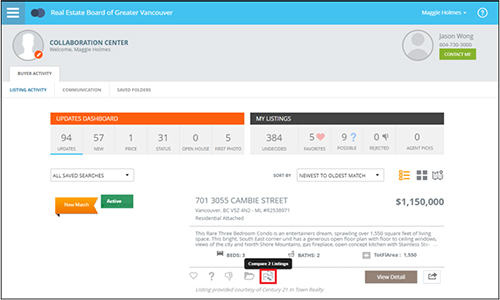

Clients can view properties side-by-side in Collaboration Centre

Using Paragon’s new compare feature, you and your client can compare listings side-by-side while in Collaboration Centre. You can access this feature by clicking on the new “Compare 2 Listings” icon on each of the two listings you want to compare to launch the new side-by-side comparison view.

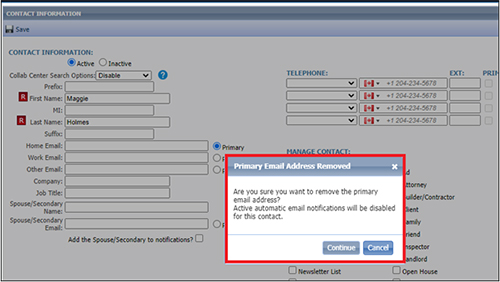

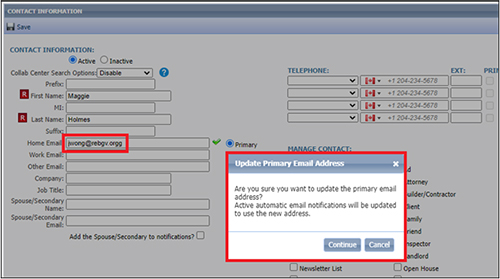

New pop-up notifications when you change or delete a client’s primary email

You’ll now see a pop-up message asking you to confirm changes when you remove or change a client’s email address if they have automatic notifications enabled.

If you confirm a client’s email is being deleted, the system will disable all automatic notifications for buyer activity, seller activity, and agent recommended.

If you confirm a client’s email has changed, the system will send all automatic notifications for buyer activity, seller activity, and agent recommended to the updated email address.

Questions? Call the Help Desk at 604-730-3020 or email support@rebgv.org.

Federal agency proposes new minimum qualifying rate for uninsured mortgages

The Office of the Superintendent of Financial Institutions (OSFI) began consultation yesterday on a proposed increase to the minimum qualifying rate for uninsured mortgages.

The federal agency is looking to make the qualifying rate for uninsured mortgages the higher of the mortgage contract rate plus two per cent or 5.25 per cent as a minimum floor.

The stress test is currently set as the higher of the contract rate plus two per cent, or the prevailing benchmark rate (4.79 per cent). The proposed 5.25 per cent rate was the prevailing average benchmark in the 12 months leading up to the pandemic.

OSFI also wants to revisit the calibration of the qualifying rate at least once a year, “to ensure it remains appropriate for the risks in the environment.”

“The current Canadian housing market conditions have the potential to put lenders at increased financial risk. OSFI is taking proactive action at this time so that banks will continue to be resilient,” said OSFI in a news release.

OSFI is asking for feedback on this proposed qualifying rate by email to B.20@osfi-bsif.gc.ca before May 7.

The final amendments to the qualifying rate for uninsured mortgages will be communicated by May 24 and will come into force on June 1.

“The more stringent stress test will modestly temper some demand pressures if enacted, particularly for down payment constrained buyers including first time owners. That said, given a supply constrained environment, this is unlikely to derail the housing market by itself,” said Bryan Yu, chief economist with Central 1 about the proposal.

We’ll provide more information about this proposed change in the weeks ahead.

Stay up to speed – follow REBGV on Instagram, Facebook, Twitter, YouTube, and LinkedIn

If you’re looking for the latest real estate news, market stats or infographics to share with clients, follow our social media accounts! REBGV has a presence on most major social media sites.

In a world where information flows faster than ever, following our social media accounts is a great way to stay current on real estate.

Follow us today on:

REBGV members-only Facebook group

We also host a members-only Facebook group where you can connect and engage with more than 3,100 other REBGV REALTORS®. Here you’ll find the latest media coverage on the market, new resources, practice tips and details about our upcoming events.

Click here to join today!

BC now in third wave of COVID-19 – stay vigilant this weekend and refrain from open houses

As we're now into the province's third wave of COVID-19, your Board continues to strongly encourage you to adhere to the provincial health and WorkSafeBC guidelines for the profession. This includes refraining from holding open houses.

We also recommend you carefully consider how you advertise showings and livestreamed or virtual open houses.

“We’ve been labeled as an essential service which means we’re trusted enough to safely represent our clients. We can’t violate that trust,” said Taylor Biggar, Board Chair. “It’s important for all of us to think about that when we use terms like ‘open houses’. Even when they’re by appointment, the term can easily be misinterpreted.”

The real estate boards and regulatory bodies in our province continue to urge you to limit in-person interactions. Where possible, use technology-based solutions for activities such as showcasing a home, assessing neighbourhood amenities, and completing paperwork.

While Realtors are still permitted to conduct home showings, you’re expected to always wear a mask, to limit the number of people inside a home at once to six or less, and to ensure that people aren’t gathering outside of a home.

Also make sure to familiarize yourself with the latest safety protocols:

- Guidelines for showings

- Guidelines for offices and Managing Brokers

- WorkSafeBC Real Estate Guidelines

Stay safe and have a great weekend.