Featured News

FINTRAC and LOTR updates: What you need to know about your anti-money laundering obligations

Stay on top of the recent changes to your anti-money laundering (AML) obligations. Here’s what you need to know:

FINTRAC reporting changes now in effect

New FINTRAC reporting obligations for REALTORS® came into force on June 1. Click on one of the changes below to see FINTRAC’s updated requirements relating to:

- When to verify the identity of persons and entities;

- Methods to verify the identity of persons and entities;

- Know your client requirements, including:

- Record keeping requirements.

Grace period for new obligations

FINTRAC implemented a grace period for the new compliance rules from June 1, 2021 to March 31, 2022 as a result of the Canadian Real Estate Association’s lobbying efforts.

While REALTORS® are still required to adhere to the new obligations, FINTRAC will focus on assessing the pre-June 1, 2021 requirements, as long as Realtors try to comply in good faith with the new, stricter rules.

Learn more about this grace period from FINTRAC here.

To help you understand your obligations under these changes, use the different resources and learning options available:

- Our detailed look at what’s changing.

- CREA's updated materials on FINTRAC compliance.

- BCREA’s materials on money laundering obligations.

- BCREA’s podcast on the FINTRAC updates.

- BCREA's June 2 webinar on the FINTRAC changes.

- Focus on virtual currency obligations.

- PDF version of a before-and-after infographic.

Resources from Council

- Breakdown of the new requirements (PDF)

- A video discussing your anti money-laundering obligations and how to work with clients

- Considerations when working with a buyer client

- Considerations when working with a seller client

- FAQs

Land Owner Transparency Registry

On April 30, the BC Land Title and Survey Authority (LTSA) made the Land Owner Transparency Registry (LOTR) searchable to the public via their myLTSA portal. People can search for owners (individuals and corporations) or by a parcel identifier (PID). Each search will cost $5. Click here for more details.

Resources for REALTORS®

- Council’s LOTR resource page has all the information you need, including a breakdown of the LOTR and guidelines you should follow.

- 10 quick things REALTORS® should know about the LOTR.

Improvements coming to your Data Input Form in July

In July, we’ll implement several updates that members have been requesting for the Data Input Form in July. Here are the details:

- The REALTOR® Remarks will expand to 500 characters, up from the current 300 characters. This long-standing request will allow you to communicate more information to other members about disclosures, delays in showings, delays in offers, showing instructions, and more.

- Many fields are increasing the number of selections you can include. You’ll be able to select a max of two options for foundation type (field 230) and driveway finish (field 248), a max of four options for floor finish (field 272), and up to 10 options for amenities (field 330).

- A new field will be included to report square footage for a second detached residence on a property (i.e., a laneway or coach house).

- There will be space to add six additional rooms for a total of 36 rooms, up from the current 30. There will also be a slight change to the way you enter room information on the Data Input Form. See below for an example:

FLOOR LEVEL |

ROOM NAME |

| MEASUREMENT X MEASUREMENT | |

- A new field called “ABOVE MAIN 2” will be included to report finished floor area square footage for an additional floor above the main floor. You’ll also see the “ABOVE MAIN 2” option when entering bathroom information.

- Page six of the form, which deals with strata information like bylaws, fees, and restrictions, has been redesigned for a cleaner layout. It’ll also include a new field for stratas that allow short-term rentals.

- Field 146 regarding GST being included in the sale price will become mandatory if the age type in field 144 is either new (NE) or under construction (UC).

- There will be a new option (pellet) for fuel/heating (field 262).

Questions or concerns? Call James Lindow at 604-730-3085 or email jlindow@rebgv.org.

Death, taxes, and rules

“In this world, nothing is certain except death and taxes,” said Benjamin Franklin in 1789. What’s equally certain is you can’t write a rule or a law covering every conceivable situation. You can get close, but not all the way there.

Our former legal counsel, Brian Taylor, used to say, “Let’s write a rule covering 95 per cent of situations, and then we’ll just deal with the remaining five per cent as they arise.” He said this after a particularly long, excruciating meeting where we’d been discussing agency in all its forms. The group had been getting bogged down on obscure “what if” questions.

Also certain is our capacity as professional problem-solvers to find a rule work-around or, at least, to spend a lot of time looking for one. Add all the different member business models and the expectations that go with them, and it’s not surprising there isn’t uniform agreement as to who should be at a showing or appointment—the seller or the buyer’s agent. Similar to the “low pricing to get multiple offers” scenario, there isn’t much middle ground to this discussion.

I’ve written about this before, but it’s been a while, so let’s do a recap.

When I write my column, I usually think of a title first, then I write the column. For this column, my first title was “That ain’t my job.” But the Franklin quote has more punch (and better grammar), so I went with it instead. There’s enough to write three columns on this subject, ranging from “Who should be there” to “That’s not my job” to “It’s your job if your client says it’s your job.” What a can of worms. If you’re excitable, I suggest you self-medicate before reading on.

Today, we’re reviewing Rule 6.02. I hope it’s clear that you must never contact another member’s client directly without the consent of their agent.

6.02 Appointments

(a) Appointments by Cooperating Brokerages to inspect or show property may not be made directly with the seller unless otherwise specified on the data input form and published listing information; and

(b) Cooperating Brokerages must ensure that the buyer(s) is accompanied and supervised by a licensee throughout the appointment.

Part (b) was added to this rule a few years back after considerable time spent wordsmithing it to specify who should be at the showing, appointment, and/or inspection.

There really wasn’t a practicable way to draft a concise rule conceiving, in advance, who ought to be present. Eventually, we settled with this: “someone with a license has to be there; members are professionals and they’re agents and they should be able to work out what’s best for the situation.”

About five per cent of situations lead to thoughts and conversations like, “I shouldn’t have had to do that. It was the other member’s job. They’re just lazy.”

Sellers’ agents often expect buyers’ agents to show the property to their buyers. That’s fine. Reasons for this may include, “It’s not my job to show the property to buyers—that’s the buyer agent’s job.” “They should do the work by showing the place if they want to earn a commission.” “It’s better risk management if the buyer’s agent shows the place to the buyer.”

Some sellers’ agents are reluctant to deal directly with another member’s client, preferring instead to keep things simple. They act for the seller; the other person does all the other stuff. Some say there’s less chance of a miscommunication if the buyer and seller only ever talk to their own agents.

As an aside, lawyer Brian Taylor says it’s an agent’s job to do something if the client says so unless that something is illegal or the agent has good reason to refuse and is willing to walk away from the relationship if the client insists.

In the public sphere, the “it isn’t my job department” argument is likely considered unbecoming of us. I doubt it would play well. Two agents squabbling rarely reflects well on our profession.

So, let’s be clear: any licensee from either brokerage can stand in for a member who can’t attend an appointment. It could be the seller’s agent or the buyer’s agent or some other agent who’s been nominated to stand in for the unavailable agent.

I personally think it’s a bad idea for buyers to be shown a property by the seller’s agent if their own agent isn’t going to be in attendance. Why? Because buyers can blab their personal information to the seller’s agent, perhaps hampering their ability to negotiate the best deal. (Maybe that’s a plus if you’re the seller’s agent. But things can also get uncomfortable and murky if someone else’s agent hears something they wish they hadn’t heard). And they may not even be aware of questions their buyer’s agent would ask, making it riskier for the seller’s agent to show the property to someone else’s client. Why complicate things? Keep it simple. Be there with your client.

If a seller agent’s position is they don’t want to show other members’ buyers the property without their agent being there, they should get written instructions, preferably on the listing’s Schedule A, with a corresponding note in R/Remarks. Ditto for sellers’ agents who have instructions from their sellers NOT to deal with unrepresented buyers (meaning, “I have instructions not to work with unrepresented buyers. Please hire you own agent—I’m only providing services to the seller.”)

What do buyers and sellers want? They want a smooth deal. That’s what we want too, except sometimes human nature being what it is, we find it hard to get to “smooth” all the time.

What does your Professional Conduct Committee expect? Look after your client, which sometimes requires a bit of flexibility and good grace.

Top Tip video: That's not my job

Kim discusses these issues further in the video below:

Optimize Paragon’s search tools to find the right properties for your clients

Finding properties for your clients is fundamental to your work as a REALTOR®. Paragon offers a variety of ways for you to filter your searches and input criteria so you can find the properties that you and your clients are looking for - here’s a rundown:

Search by criteria

Standard searches on Paragon are based on selecting criteria to locate properties. You can choose from basic criteria like property type, price and date ranges, and areas and sub areas. The criteria you select will appear in the criteria summary box on the right side of the screen along with a running count of properties that match the criteria you’ve selected.

Search by feature

If your client is looking for a certain feature in their new home, a feature search will narrow your results from the criteria search.

For example, you can search for properties with a laneway or coach home, properties with a suite, den, or pool, and pretty much any other feature tracked in Paragon.

Search using maps

If location, location, location is most important for your client, do a map search to find a property in their desired neighbourhood. You can switch to a map view from the criteria search at any time to see the results on a map. You can use shapes to draw your own boundaries on the map to see the properties within a specific area, or to exclude that area from the rest of your search.

Power search

Paragon’s power search is a great way to search for properties when you don’t have the property’s complete address. Power search uses numeric strings to display results, which means it’ll display exact matches before displaying addresses that start with what you enter. For example, if you enter ‘555’ in the search field, Paragon will display addresses that start with ‘555’ before displaying addresses that start ‘5551’ or ‘5554’.

Use our Paragon search guide

You’ll find more details and walkthrough information on these searches in our Paragon search guide. You’ll also find information about how to save and assign your searches to clients for easy recall.

Need help with your Paragon searches? Call our Help Desk at 604-730-3020 or email support@rebgv.org.

Opportunities in commercial and residential, Cambie Corridor update, and Mayor Kennedy Stewart talks Vancouver’s post-pandemic housing needs

Opportunities on the horizon for commercial and residential REALTORS®

In the coming years, Metro Vancouver commercial and residential Realtors can expect activity to grow exponentially, attendees learned at a NAIOP live webinar. Here’s why.

Cambie Corridor update

The Cambie Corridor is now the biggest growth area in Vancouver, and in the next 30 years is expected to double in population and add more than 30,000 new homes in several areas.

Mayor Kennedy Stewart talks to members

After COVID-19, affordable housing is the top issue in Vancouver. Mayor Kennedy Stewart detailed what council plans to do about it.

Board of Directors proposes amendment to REBGV Regulations

To ensure that REBGV stays on top of leading governance practices, your Board of Directors works with its committees to review, update and improve the regulations that the organization follows.

As part of this work, REBGV’s Board of Directors is proposing to repeal Regulation 3.1 – Elections, Directors-at-large and replace it with a revised Regulation 3.1 – Elections, Directors-at-large.

The proposed new Regulation 3.1 can be viewed here and can be compared to the current Regulation 3.1 here.

What’s changing?

Regulation 3.1 has been re-written to better reflect the modern electronic voting process that REBGV has followed over several years for Directors-at-large elections.

Until now, the Regulation had been amended on an ad-hoc basis to address specific changes in our election process. Despite these ad-hoc changes over time, the overall regulation remains rooted in the former paper ballot process and therefore requires rewriting and modernizing.

In addition to changes to reflect our modern voting practices, the proposed amendments seek to address issues that have arisen in recent Directors-at-large elections and give the Board tools to deal with those issues should they arise again. These proposed changes are explained below for your convenience.

- The Board Development Committee oversees the process for the nomination of Director candidates. Since 2015, the Committee’s process has included assessing the skills, knowledge and experience of candidates, and recommending those candidates who the Committee determines have the requisite skills, knowledge and emotional intelligence to meet the identified needs of the Board in any given election year. The proposed Regulation codifies the Board Development Committee’s role in recommending candidates, including publishing the recommendations.

- The Board Development Committee’s role has not included verifying the claims candidates make in their nomination materials. The Board of Directors has, however, determined that the Committee should have the flexibility to investigate the validity of the information candidates provide, where warranted, as well as the tools to deal with a candidate who has deliberately provided false or misleading information in their nomination material. The proposed Regulation gives the Committee the ability to end the candidacy of a nominated candidate in certain egregious circumstances. Prior to the start of the next election cycle, this process will include a robust framework for the Committee to follow within the Committee’s Terms of Reference.

- It is not uncommon for members to seek staff assistance in the hours leading up to the deadline to submit nomination papers, or to vote electronically in the election. Those deadlines are currently defined as end of day, i.e., midnight, when staff is not available. The proposed Regulation moves those deadlines to specified times within normal business hours, to ensure that members have access to staff assistance if needed.

- The existing Regulation requires that the “voters list” be prepared on the first business day in January and be finalized on January 10. This means that any member who was in the process of transferring brokerages, and therefore “inactive”, during that period would be excluded from the voters list and arguably ineligible to vote in the subsequent election. The proposed Regulation expands the “voters list” to include all members in good standing, with active log-in credentials while voting is open.

- The scrutineering process described in the existing Regulation is a holdover from the paper ballot days when ballots were physically opened and counted in the presence of scrutineers, and candidates were entitled to observe ballot counting. With elections having been conducted electronically for many years now, election results are instantaneous with the download of a report from the third party online voting system provider. The proposed Regulation better describes the scrutineering process in the modern online environment.

Have feedback on these proposed changes?

The Board of Directors will vote to adopt the new Regulation at its June 17 meeting. If you have comments or questions regarding the proposed Regulation, email Arnelle Starnaman at astar@rebgv.org or Tina Creed at tinac@rebgv.org as soon as possible, but no later than June 16.

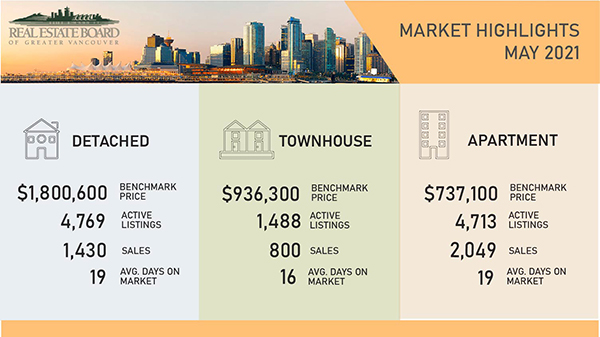

Home sale and listing activity in Metro Vancouver moves off of its record-breaking pace

The Metro Vancouver housing market saw steady home sale and listing activity in May, a shift back from the record-breaking activity seen in the earlier spring months.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 4,268 in May 2021, a 187.4 per cent increase from the 1,485 sales recorded in May 2020, and a 13 per cent decrease from the 4,908 homes sold in April 2021.

Last month’s sales were 27.7 per cent above the 10-year May sales average.

“While home sale and listing activity remained above our long-term averages in May, conditions moved back from the record-setting pace experienced throughout Metro Vancouver in March and April of this year,” Keith Stewart, REBGV economist said. “With a little less intensity in the market today than we saw earlier in the spring, home sellers need to ensure they’re working with their REALTOR® to price their homes based on current market conditions.”

There were 7,125 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in May 2021. This represents a 93.4 per cent increase compared to the 3,684 homes listed in May 2020 and a 10.2 per cent decrease compared to April 2021 when 7,938 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 10,970, a 10.5 per cent increase compared to May 2020 (9,927) and a 7.1 per cent increase compared to April 2021 (10,245).

"With sales easing down from record peaks, a revised mortgage stress test that reduces the maximum borrowing amounts by approximately 4.5 per cent, and the average five-year fixed mortgage rate climbing back over two per cent since the beginning of 2021, we’ll pay close attention to these factors leading into the summer to understand what affect they’ll have on the current market cycle,” Stewart said.

For all property types, the sales-to-active listings ratio for May 2021 is 38.9 per cent. By property type, the ratio is 29.8 per cent for detached homes, 53.8 per cent for townhomes, and 43.5 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“The seller’s market conditions experienced throughout much of the pandemic highlight the need for increasing the volume and variety of housing supply across our region,” Stewart said. “Doing this requires a more disciplined focus on planning, reducing building costs, understanding demographic changes, and expediting the building approval process.”

The MLS® Home Price Index1 composite benchmark price for all residential properties in Metro Vancouver is currently $1,172,800. This represents a 14 per cent increase over May 2020 and a 1.5 per cent increase compared to April 2021.

Sales of detached homes in May 2021 reached 1,430, a 166 per cent increase from the 537 detached sales recorded in May 2020. The benchmark price for a detached home is $1,800,600. This represents a 22.8 per cent increase from May 2020 and a 1.7 per cent increase compared to April 2021.

Sales of apartment homes reached 2,049 in May 2021, a 213 per cent increase compared to the 653 sales in May 2020. The benchmark price of an apartment home is $737,100. This represents a 7.9 per cent increase from May 2020 and a 1.2 per cent increase compared to April 2021.

Attached home sales in May 2021 totalled 800, a 168 per cent increase compared to the 298 sales in May 2020. The benchmark price of an attached home is $936,300. This represents a 16.3 per cent increase from May 2020 and a 1.8 per cent increase compared to April 2021.

Click here to download the May 2021 stats package.

Other News

How will the new mortgage stress test rules impact Metro Vancouver real estate?

The Office of the Superintendent of Financial Institutions (OSFI) and the Minister of Finance, Canada’s banking regulators, tightened the rules around the mortgage stress test on June 1.

Under the new requirements, all mortgage applicants must be able to afford their mortgage at an interest rate of 5.25 per cent or two per cent over the contract rate, whichever is higher, regardless of their down payment.

How will the new stress test impact home buyers?

Regulators introduced the stress test for insured mortgages in 2016 and for uninsured mortgages in 2018. This original stress test required borrowers to qualify at the greater of the benchmark posted rate for a five-year term or 200 basis points over the contract rate. This change reduced home buyers’ purchasing power by approximately 20 per cent and was a key factor behind the decline in housing market activity in 2018 and 2019.

This most recent adjustment to the stress test is anticipated to decrease the amount home buyers’ can borrow by approximately four per cent.

“While we saw a large impact on home buyers the last time the stress test rate increased, the magnitude of these changes is quite different,” said Keith Stewart, REBGV Economist. “A four per cent reduction in a home buyer’s maximum budget is unlikely to move too many people in or out of the market, or change the type or location of home they choose to buy.”

The new rules will dampen mortgage credit growth, but should have a modest effect on home sales and prices in the region going forward, according to Stewart.

Our message to the public who are looking to get into the housing market today is that it’s critical to work with your REALTOR® and mortgage specialist to carefully review your financial situation and ensure you’re always making responsible, long-term borrowing decisions.

With that in mind, click here to access this article online and share it with your clients or post it to your social media accounts.

Who’ll be the next REALTORS Care® Award recipient?

Find out at our REALTORS Care® Award presentation on Tuesday, June 22 at 10 a.m.!

The member receiving this award has made incredible contributions to the community and profession this past year.

So who’s this year's recipient? Watch as Board Chair Taylor Biggar reveals the REALTOR® who has initiated and participated in a variety of charitable events to help make life better for others during a challenging year.

We’ll send you the link to this event closer to the day.

About the REALTORS Care® Award

The REALTORS Care® Award recognizes the contributions Realtors and their companies make to our communities. These are the charitable all-stars in our profession who consistently raise funds, volunteer for worthy causes, and do other good deeds in their communities. Past recipients include Debi Pearce, Jody Squires, Laura-Leah Shaw, John Patricelli, Ron Antalek, Sing Yeo, and many more.

Register for one of our upcoming virtual events!

We're adding new member events all the time. Register for one of our upcoming virtual member engagements - here are the details:

Strata issues with Tony Gioventu: Restrictive bylaws

Tony Gioventu, President of the Condominium Home Owners Association, is back for a session on restrictive bylaws for strata properties.

Strata properties are a large segment of our real estate market. Learn about the varied restrictions some strata corporations enforce and how to best advise your clients.

Tony’s presentation will cover:

- Pet restrictions.

- Age restrictions.

- Long- and short-term rentals and everything in between.

Touchbase workshop for REALTORS®

Are you getting the most out of Touchbase? Want to know more about how it works?

We’re hosting a free Touchbase workshop for members on June 10. Evelyne Paar, Assistant Director for Touchbase, will host the session and offer live demonstrations, including a walkthrough of setting up your profile and preferences and a quick troubleshooting guide.

Is there something else you’d like to see? Email us at hostedevents@rebgv.org with a description of what you’d like demonstrated and we’ll work with Evelyne to feature your request.

Meeting future housing needs in the City of Burnaby

Join us for an informative presentation on the City of Burnaby’s future housing needs. Our presenter is Lee-Ann Garnett, Assistant Director for Long-Range Planning with the City of Burnaby.

Lee-Ann will discuss:

- Burnaby’s housing story and how approaches to delivering housing have changed over time.

- The Mayor’s Housing Task Force on Community Housing.

- New tools to support rental supply and renters.

- An update on residential construction in Burnaby.

Autoprop: What REALTORS® need to know

Autoprop is one of the key business tools we provide for you. It’s a central hub for your real estate data that allows you to convert zoning, school catchment, permit, and other property information into comprehensive, branded reports for your clients.

On June 23, learn more about what you can do with this powerful tool! Autoprop’s Jusleen Phagura will lead a session that reviews the features, data, and reports you can use, along with a preview of some of the key improvements they’re working to deliver.

Errors and Omissions: Mitigating risks and preventing mistakes

Join us online for an informative session focusing on the benefits that the Real Estate Errors and Omissions Insurance Corporation (REEOIC) provides to members, along with some of the most common claims they receive. REBGV past Chair Calvin Lindberg will moderate this session.

Our expert panel includes:

- Leslie Howatt, Executive Officer, REEOIC

- Chris Johnston, staff lawyer, REEOIC

- Dave Peerless, President and Managing Broker, Dexter Realty

They’ll share their experiences and anecdotes while highlighting the value REEOIC brings to brokerages and Realtors. Learn about the most common mistakes Realtors make and how REEOIC assists them by providing lawyers and limiting their exposure to large financial penalties.

Discussion topics include:

- REEOIC update and background.

- The Indemnity Plan – what’s covered and what isn’t.

- Claims update.

- Why we get claims and how to avoid them.

- What to do when you have a claim.

Changes are coming to your digital statements this month thanks to your feedback

Last month, we sent you our first ever digital statements instead of mailing paper copies. As with most changes, some growing pains emerged that we’re working through to make sure this is an efficient, secure process that doesn’t complicate your workflow for processing the statements.

Changing the email template

The most common feedback we received was around the look of the email. Initially, we sent a small description with a link to your statements on REBGV.ca.

You let us know that this email looked suspicious, and following digital security best practices, many of you called in to verify this email was from REBGV.

We’ve now applied our branding to these emails and included instructions on how to access your statements without clicking a link. This should help give you confidence that these are legitimate messages.

Click here to see an example of what our updated emails look like.

Better access to statements at Broker-billed offices coming soon

Managing Brokers also told us that statements for Broker-billed offices were cumbersome to share with the administrative or accounting people who process them.

We’re exploring solutions to make this process more efficient for your office. We understand this impacts your workflow and we appreciate your patience as we work on a better solution.

In the meantime, only the Managing Broker on record for your office, and anyone who has identity sharing set up with that Managing Broker, can access the statements online.

To share your statements by email, you’ll need to log in to REBGV.ca, or follow the links in our monthly email, download a PDF copy of your statement and send it as an attachment.

To download your statement: go to your “My Profile” section on REBGV.ca, click “My Statements” in the left-hand column, then choose “View Statements” and save it as save a PDF document.

If you have questions about your invoices or statements from the Board, please email us at accounting@rebgv.org.

Thank you for your patience and assistance as we work to refine this new paperless process.

BC’s move to a single real estate regulator to complete this summer

The BC Financial Services Authority (BCFSA) will complete its integration with the Real Estate Council of BC (Council) and the Office of the Superintendent of Real Estate this summer.

BCFSA also announced its leadership team. Current BCFSA CEO Blair Morrison will retain his role, while current Council CEO Erin Seeley will become Senior Vice President of Policy and Stakeholder Engagement and current Superintendent of Real Estate Micheal Noseworthy will become BCFSA’s Senior Vice President of Compliance and Market Conduct.

Click here to see BCFSA’s management team.

Background info

According to BCFSA, the integration will simplify accountabilities and enhance regulatory oversight through more effective and efficient business processes, investigations, and enforcements.

Creating a single financial services regulator was a key recommendation from the Expert Panel on Money Laundering Report released in May 2019 and the Real Estate Regulatory Structure Review conducted by Dan Perrin in September 2018.

The provincial government first announced this change in November 2019.

What to expect

BCFSA will have authority over real estate education and licensing as well as investigations and discipline responsibilities for licensed and unlicensed real estate activity, including real estate development marketing. It’ll also have rule-making authority governing the conduct of real estate licensees.

Until the integration is complete, BCFSA, RECBC and OSRE will continue to carry out their individual legislated responsibilities and operate as separate organizations.

We’ll share more information on this as it becomes available.